![图片[1]-Jim Dalton – Advanced Nuances & Exceptions ECourse-TheTrendFollowing](https://150220.xyz/wp-content/uploads/2023/05/777111b22d191251.jpg)

![图片[2]-Jim Dalton – Advanced Nuances & Exceptions ECourse-TheTrendFollowing](https://150220.xyz/wp-content/uploads/2023/05/21cc2852f6191251.jpg)

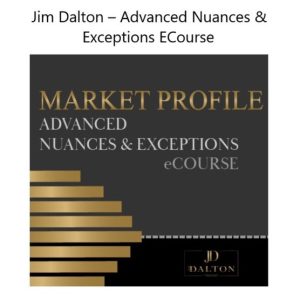

Welcome to the Advanced Nuances and Exceptions Course. This is a collection of dissimilar days that cover a plethora and variety of the namesake title of this course.

We hope that this collection of examples will help you stretch your imagination and guide you in making randomness work for you, aid in helping you understand the market beyond structure, and how context and the interaction of tempo, liquidation, excess, value, and other factors give you clues and an edge in your trading. * This course is for traders who have a solid foundation and understanding of Market Profile and the concepts that Jim teaches.

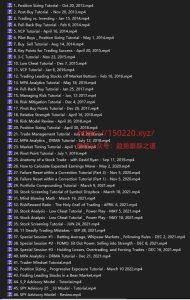

Course Outline:

1. Culmination Of Where You Need To Be To Trade Successfully

2. Making Randomness Work For You

3. Liquidation Alone Is Not More Powerful Than Liquidation With New Money Selling

4. Recovery & Retrace Following Liquidation Only

5. Meaningful Liquidation With A Fast Recovery On The Same Day

6. Trading Value – Contextual Clue of the Day

7. A Rotational Day Within Balance With The Purity of Only Short Term Traders

8. No Meaningful Excess At the All Time Highs

9. Understanding The Market Beyond Structure

10. Perfect Example Of Trading A Gap

11. The Continuous Two Way Auction Process – Bringing It All Together

12. The Total Trader – A Total Trading Day

13. How Structure Captures the Relationship Between Participants

14. The Day Jim Disregarded Tempo & The Dynamics & Characteristics Of Trading An Inside Day

15. Volatility & Sequencing

16. Tempo As A Leading Indicator

![4、[技术教程]回撤买入法视频教程 PullBack Buy Tutorial By Mark Minervini 中英字幕人工校正-TheTrendFollowing](https://150220.xyz/wp-content/uploads/2023/05/07aee2b72d084244-300x211.png)