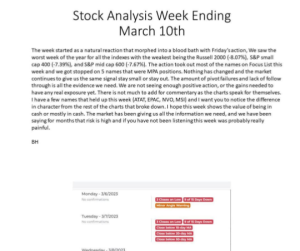

![图片[1]-Gary Dayton Winning Trades Procedure Using Multiple Time Frame-TheTrendFollowing](https://150220.xyz/wp-content/uploads/2024/09/9cc8c0e84d171314.jpg)

![图片[2]-Gary Dayton Winning Trades Procedure Using Multiple Time Frame-TheTrendFollowing](https://150220.xyz/wp-content/uploads/2024/09/40d190caf0171312.jpg)

Trading the intraday markets on a 3 or 5-minute time frame can be a real challenge. Things happen very quickly. Volatility occurs first on the intraday charts, often with little warning.

Indicators like RSI, MACD, and moving averages are useful, but they often give false signals. Many traders become frustrated, missing solid trades, taking poor trades, getting in late, or getting out early.

If you are like most traders, you would want to be able to pinpoint the winning trades.

Fortunately, there is a way: Dr. Gary has developed a trading procedure that helps lift the intraday fog. This trading procedure helps you identify the high probability entry and exit locations of your trades.

In this course, Dr. Gary will show you how to use a combination of time frames to trade the intraday market so you can stop the struggle and improve your chance of executing the winning trades. By using the interplay between a higher and lower time frames, you can begin to see the market and what it is doing more clearly and with a greater degree of confidence.

Based on the Wyckoff Method, Dr Gary will show you how to read multiple time frames simultaneously for a true insight into the market actions.

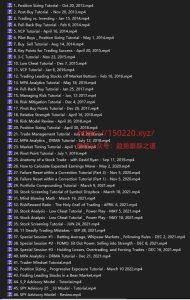

The course covers:

How to read the “Key of the Day” time frame to help you keep on the right side of the market

How to read both higher time frame and the trading time frame bar-by-bar for a true trading edge

Improve Your Trading Results & Elevate Your Confidence

Recorded video tutorial for almost 3 hours of teaching

![4、[技术教程]回撤买入法视频教程 PullBack Buy Tutorial By Mark Minervini 中英字幕人工校正-TheTrendFollowing](https://150220.xyz/wp-content/uploads/2023/05/07aee2b72d084244-300x211.png)

![[Video Course]Al Brooks - Reading Price Charts Bar by Bar The Technical Analysis of Price Action for the Serious Trader-TheTrendFollowing](https://150220.xyz/wp-content/uploads/2023/05/96b443671b161240-300x300.jpg)