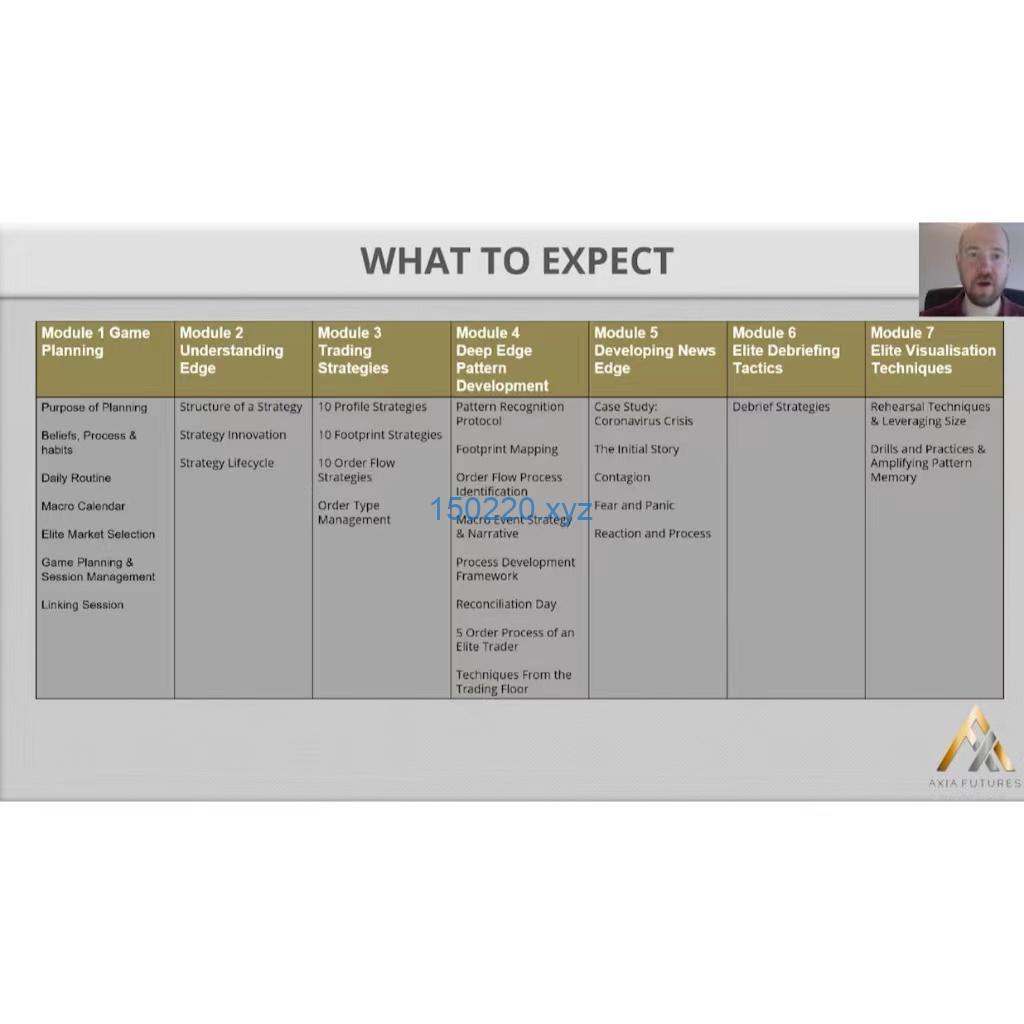

Course Curriculum

DAY 1 – MARKETS

Capital Markets, Asset Classes, Derivatives

Trader Development – Routine

DAY 2 – BECOMING A TRADER

Trading Plan, Routine, Trader Development

Trader Development – Goal Setting

DAY 3 – TECHNICAL ANALYSIS

Charts – Candlesticks, Patterns, Entries and Exits

Indicators – Volatility Indicators, VWAP, ATR, Volume/Delta

DAY 4 – VOLUME PROFILE AND PRICE LADDER

Volume Profile – What it Shows

Volume Profile – Trade Setups and Opportunities

Price Ladder Momentum and Absorption

Technical Analysis Quiz

DAY 5 – FUNDAMENTAL ANALYSIS

Economic Indicators – Macroeconomics, Economic Releases, Trading Opportunities

Company Reporting – Earnings, M&A, Trading Opportunities

Government Auctions – How they Work and Trading Opportunities

DAY 6 – CENTRAL BANKS

Monetary Policy and Major Central Banks

Central Bank Communication and Trading Opportunities

Fundamental Analysis Quiz

DAY 7 – STYLE AND STRATEGY

Styles Compared

Strategy Development

Trader Development – Strategy

DAY 8 – DEBRIEF AND IMPROVEMENT

Review the Market and Yourself

Identifying Improvements and Setting Challenges

Trader Development – Debrief

DAY 9 – SUMMARY

Course Summary

课程设置

第1天-市场

资本市场、资产类别、衍生品

交易员发展-常规

第2天——成为一名交易员

交易计划、常规、交易者发展

交易员发展——目标设定

第3天-技术分析

图表-蜡烛、图案、入口和出口

指标-波动性指标、VWAP、ATR、成交量/增量

第4天-交易量和价格阶梯

Volume Profile–它显示的内容

交易量概况-交易设置和机会

价格阶梯动量和吸收

技术分析测验

第5天-基本面分析

经济指标——宏观经济、经济发布、贸易机会

公司报告——收益、并购、交易机会

政府拍卖——运作方式和交易机会

第6天-中央银行

货币政策与主要央行

央行沟通与交易机会

基础分析测验

第7天-风格和策略

样式比较

战略发展

交易员发展——战略

第8天-汇报和改进

回顾市场和自己

识别改进并设定挑战

交易员发展——汇报

第9天-总结

课程总结

© 版权声明

文章版权归作者所有,未经允许请勿转载。

THE END